does instacart take taxes out of your check

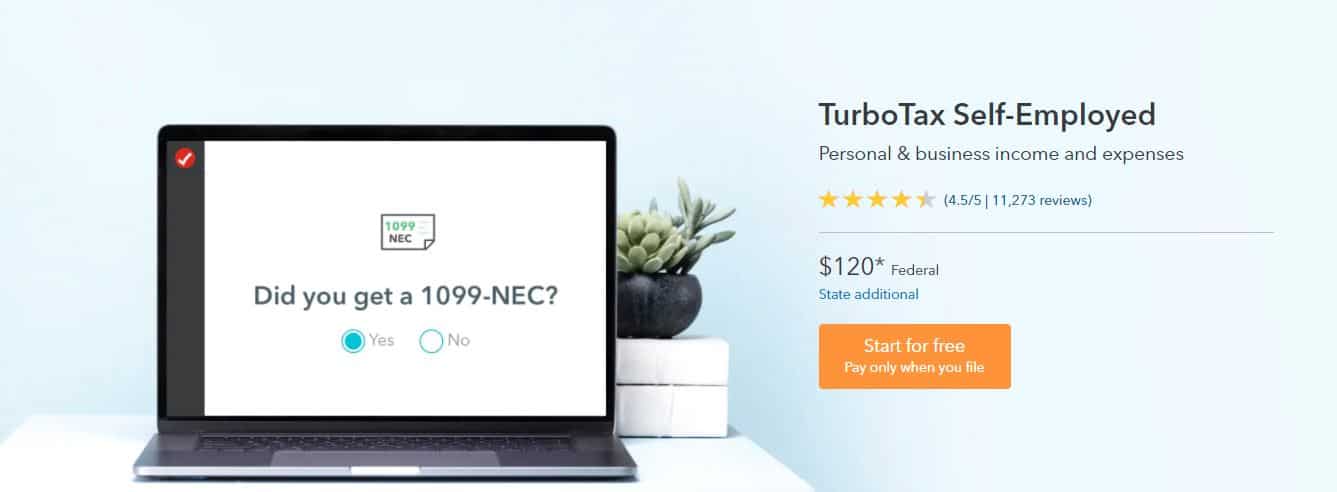

First fill out Schedule C with the amount you made as indicated in Box 7 on your. You are paid all your money in full.

Instacart Was Overwhelmed By Coronavirus Overnight Bloomberg

Unfortunately this means you need to pay quite a lot of self employment.

. Then if your state taxes personal income youll need to find out the tax rate for your state and. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. To file your quarterly taxes youll need to.

To actually file your Instacart taxes youll need the right tax form. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. There will be a clear indication of the delivery.

Knowing how much to pay is just the first step. Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes. This tax form summarizes your income for the year deductions and tax.

You will be given a 1099 misc at tax time and you will pay taxes on everything you earned. Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats. If you dont have direct deposit set up they will mail you a check.

Just go through the interview and answer the questions. The Instacart 1099 tax forms youll need to file. Then you will enter your expenses.

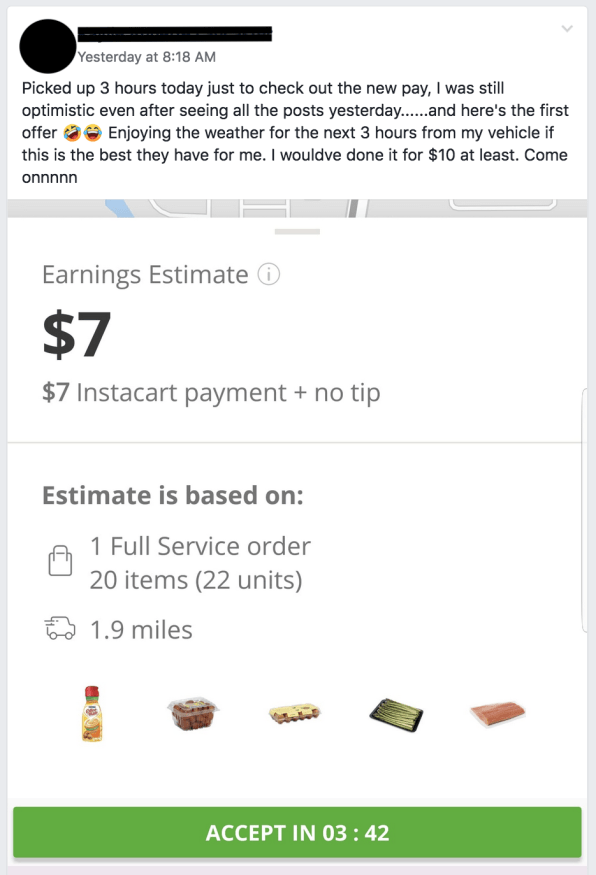

62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a. Instacart delivery starts at 399 for same-day orders over 35. Remember working as contractor for instacart or uber etc you are self employed sort of running a small business.

This is an Independent Contractor position. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s. This means that for every 100 you earn you need to pay 158 to a maximum of 88954year.

Like all other taxpayers youll need to file Form 1040. FICA contributions are shared between the employee and the employer. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the.

What Taxes Do Instacart Shoppers Need to Pay. Instacarts official name is Instacart other delivery companies use different legal names. This includes self-employment taxes and income taxes.

You can find this in your shopper account or keep records in your own bookkeeping app. If you owe more than 1000 in taxes for the year and do not pay taxes quarterly youll be hit with a late payment penalty by the IRS. Instacart 1099 Tax Forms Youll Need to File.

No taxes are taken out. What Taxes Do Instacart Shoppers Need to Pay. If you make more than 600 per tax year theyll send you a 1099-MISC tax form.

Answer 1 of 4. Instacart pays shoppers weekly on Wednesday via direct deposit for the previous Monday through Sunday week. Self Employment tax Scheduled SE is automatically generated if a person has.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. Instacart Is Fixing One Of The Most Controversial Parts Of Its Grocery Delivery Service If you dont have direct deposit set up they will mail you a check.

Instacart Drivers Say This Data Proves They Re Still Being Underpaid

Instacart Tax App Tiktok Search

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Can You Write Off Mileage For Instacart Zippia

All You Need To Know About Instacart 1099 Taxes

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Help Center Authorization Holds Recurring Payments And Unknown Charges

What You Need To Know About Instacart 1099 Taxes

/images/2021/11/22/man_looking_at_check.jpg)

5 Ways To Lower Taxes On Your Bonus Check Financebuzz

Shipt Vs Instacart Which Grocery Delivery Service Is Better

Instacart Taxes The Complete Guide For Shoppers Ridester Com

As Instacart Looks To Expand Its Services It Takes Steps To Retain Talent Insider Intelligence Trends Forecasts Statistics

Self Employment Taxes A Guide For Food Delivery Drivers

What You Need To Know About Instacart 1099 Taxes

How To Become An Instacart Shopper Driver Is It Worth It

How Much Do Instacart Shoppers Make Hyrecar

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

Instacart Help Center Instacart Fees And Taxes

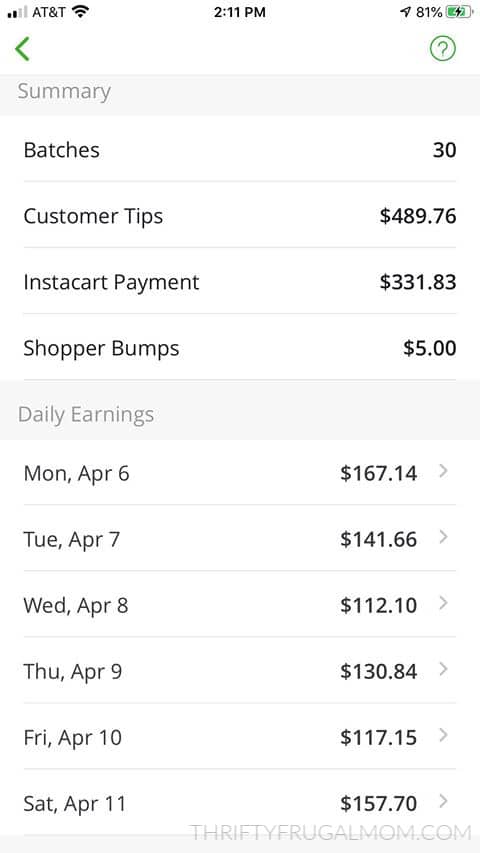

Instacart Shopper Review Made Over 1 550 Mo Working Part Time Thrifty Frugal Mom